15+ Mortgage offers

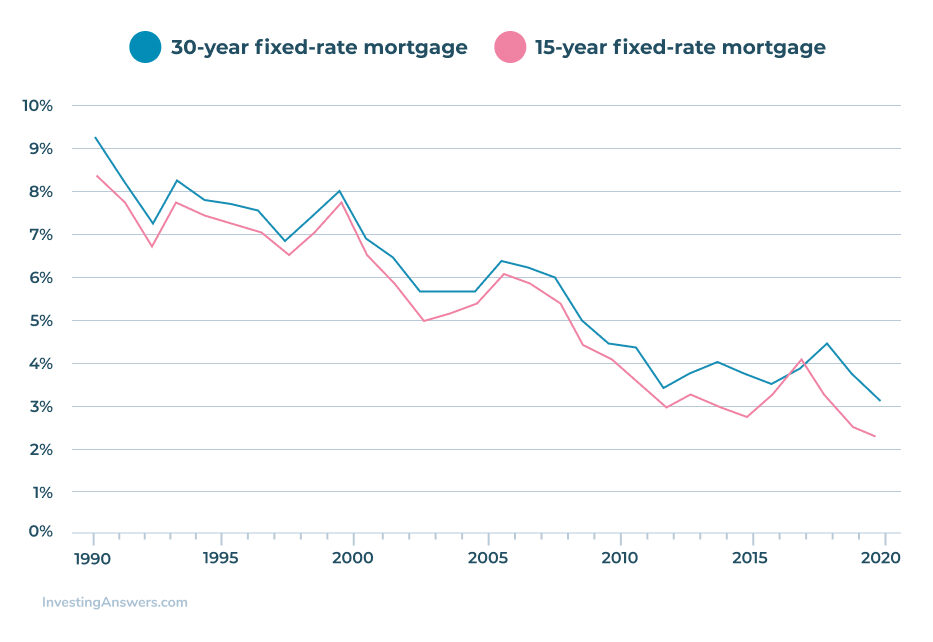

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. 51 ARM 331.

15 Mortgage Loan Calculators For Wordpress Loan Calculator Mortgage Loan Calculator Mortgage Loans

Whether youre buying or refinancing Bankrate often has offers well below the national average.

. While it offers one of the lowest monthly payments among the various term options this term will likely see you pay the most in total interest if you keep it. Non-QM Programs Commercial Loan Experts Commercial Loans We Are Expanding And. Shares of Redfin which announced layoffs earlier this week amid a slowing housing market edged up 03 in premarket trading after plunging.

Annual price growth increases to 102 in England and Wales. A 15-year fixed-rate mortgage has a higher monthly payment but greater overall interest savings compared with the 30-year term because you pay it off in half the time. Or view two different loan amounts that carry the same interest rate and repayment period.

15 th July 2022 1139 am. People typically move homes or refinance about every 5 to 7 years. Thats about two-thirds of what you borrowed in interest.

A 15-year fixed mortgage becomes more attractive it offers substantially lower rates than the 30-year. For a home purchase using a 30-year conventional VA or FHA loan Rocket Mortgage offers RateShield. Fixed-rate loan is the most popular choice for the lowest monthly payment.

Guild Mortgage offers. You can get up to five free mortgage offers in minutes. Your total interest on a 1000000 mortgage.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. We Offer Optimal Finance Options For Self-Employed Borrowers. Talk with a financial professional if youre not sure.

Neptune Investment Management BUY-TO-LET BUY TO LET. Compare two fixed rate loans with different rates repayment periods. Some home buyers may opt for a 15-year mortgage because of one major factor.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. See the monthly cost on a 250000 mortgage over 15- or 30-years. Mortgage Magic offers website help with Digital Package offering.

RDFN -575 mortgage rates have soared. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Mortgage rates valid as of 31 Aug 2022 0919 am. Your monthly payment for the 30 year loan would be 141947. Economy Economy Housing Mortgages RESIDENTIAL UK.

If the rate lock expires before your loan closes you may have the option to pay a fee to extend the lock period. While this wont immediately lower your monthly mortgage payment it can help your mortgage payments decrease later and help you pay off the loan faster. Monthly payments on a 15-year fixed-rate loan will be.

For today Saturday September 10 2022 the national average 15-year fixed mortgage APR is 5430 up compared to last weeks of 5260. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. The national average 15-year fixed mortgage APR is 5430 up compared to last weeks of 5260.

However a shorter 15-year fixed loan may save you thousands of dollars in interest charges as long as. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. This mortgage comparison calculator compares loans with different mortgage rates loan amounts or terms.

When comparing offers or services verify relevant information with the institution or providers site. REFINANCE PURCHASE A Unique Approach To Mortgage Financing Our expertise in innovative mortgage solutions combined with a comprehensive suite of products offers a unique way of mortgage financing. For the 15.

Most rate locks have a rate lock period of 15 60 days. The renovation cost must be below 10 or 15 of the value of the home depending on where you live and down payments can be as low as 3. Paying loan off faster vs 30-year loans Current avg.

Otherwise youll get the interest rate thats available when. While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year.

There are no hidden fees or obligations. Comparing quotes is a great first step to buying your dream home. The Refinance Index dipped another 1 percent putting it 83 percent lower than during the same week in 2021The refinance share of mortgage activity increased to 307 percent of total.

How much is a 15-year mortgage. If a person. 10 th August 2022 1023 am.

The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

Get Home Mortgage Loan Offers Customized for You Today. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Compare and see which option is better for you after interest fees and rates.

Build home equity much faster. With a shorter mortgage term borrowers pay off the loan quicker. APR as low as.

Todays national 15-year mortgage rate trends. Mortgage refinance rates spiked today homeowners may find the best combination of a lower rate and smaller monthly payments with a 15-year refinance.

/adjustable_rate_mortgage_what_happens_when_interest_rates_go_up-5bfc386b46e0fb00511d43c5.jpg)

Adjustable Rate Mortgage What Happens When Interest Rates Go Up

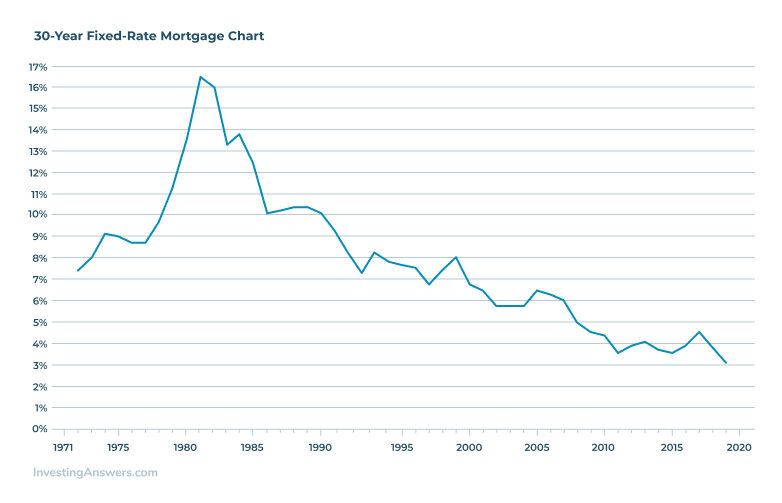

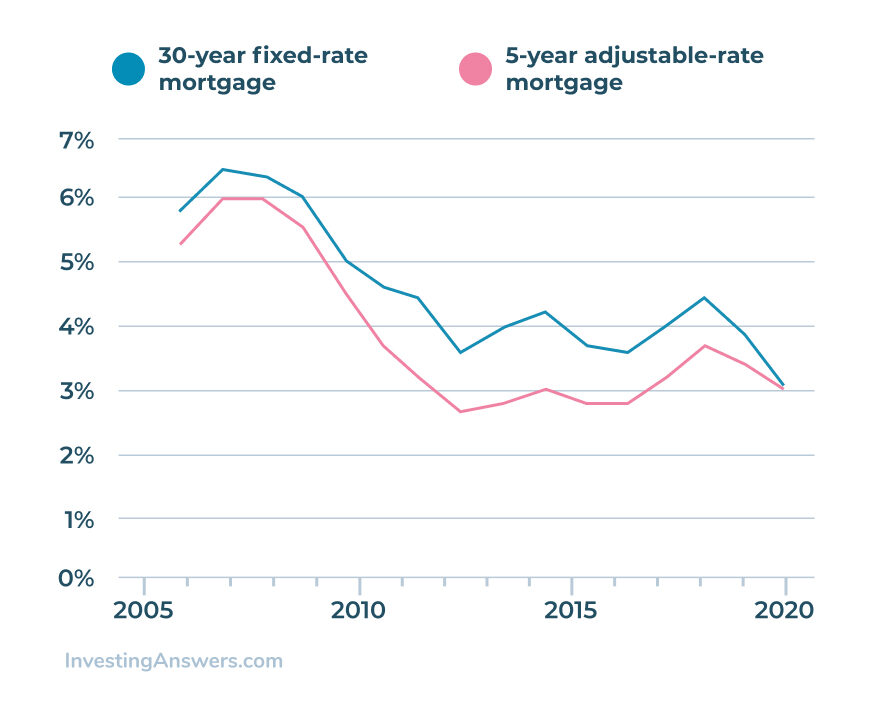

Historical Mortgage Rates In The Us Averages And Trends

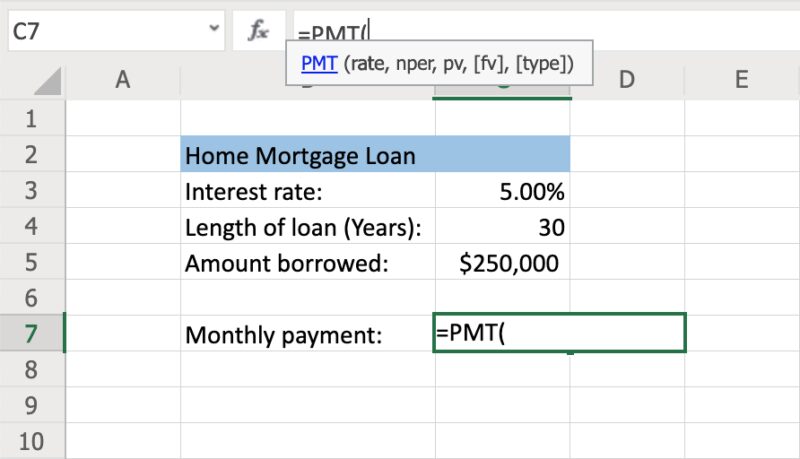

How To Calculate Monthly Loan Payments In Excel Investinganswers

When To Buy Mortgage Insurance Even When It S Not Required Ratespy Com

Historical Mortgage Rates In The Us Averages And Trends

Motusbank Mortgages Are Here Ratespy Com

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

Is It Possible To Get A Mortgage Loan Against A Plot Quora

Home The Mortgage Desk Canada

See Today S Mortgage Rates Find Which Home Loan Is Best For You

Home Purchase Residential Mortgage Broker Jhabelmortgages

Commercial Mortgage Broker In Toronto Jhabelmortgages

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Motusbank Mortgages Are Here Ratespy Com

Mortgage Insight Welch Co Mortgage Professionals

Hopewell S Preferred Mortgage Partners

Historical Mortgage Rates In The Us Averages And Trends